Atal Pension Yojana (APY) enrolments see a record of 12 million additions in FY24. The following article discusses every aspect of the Atal Pension Yojana, including the eligibility criteria and benefits.

What is Atal Pension Yojana (APY)?

Atal Pension Yojana is a social security scheme or pension scheme focused on unorganized sector workers. This does not mean that the scheme is only for unorganized workers; it is available for all Indians irrespective of their caste, creed, or social status. This government scheme was launched in 2015 by the Ministry of Finance. However, APY is administered by the Pension Fund Regulatory and Development Authority. Individuals enrolled in APY are called subscribers. Under this scheme, subscribers, after reaching the age of 60, can receive a minimum pension of 1000 to 5000 rupees per month or more, depending on their contributions.

Who are Unorganized Workers under the Atal Pension Yojana?

Unorganized workers are often considered those outside of government control. They come under little or no regulation. These workers are devoid of job security, legal protections, and other government benefits. Some of the unorganized sectors are mentioned below:

- Small-scale industry workers

- Street vendors

- Ragpickers

- Artisans

- Garment makers

- Handloom weavers

- Construction workers

Unorganized workers play a significant role in the Indian economy. However, only about 6 percent of unorganized workers avail themselves of any kind of social security benefits. Atal Pension Yojana is a great way of offering social security to those unorganized workers who are devoid of any government-sponsored benefits.

Aim of the Atal Pension Yojana

The main aim of this scheme is to address the longevity risks and to encourage workers in unorganized sectors to voluntarily save for their retirement.

Eligibility criteria for joining the Atal Pension Yojana

- Individuals should be the citizen of India

- The age of the individual must be between 18 and 40 years

- From October 2022, tax payers are not eligible for this scheme. However, those tax payers who enrolled to this scheme between 2015 and 2022, will continue to be a part of the APY scheme.

- Individuals applying for APY must have a savings bank account / post office savings bank account

- Each applicant must have a mobile number

Key Features of the Atal Pension Yojana (APY)

- Fixed pension ranging from Rs 1000 to a maximum of 5000 per month by investing through this scheme

- Subscribers will receive pension after reaching the age of 60

- The minimum period of contribution is 20 years

- Any false declaration in the application form will lead to loss of the government’s contribution and penalty

- Automatic debit

- Tax Exemptions

Penalty Terms Under the Atal Pension Yojana

If a scheme holder fails to pay his or her monthly contribution, there is a penalty associated with it. For monthly contributions worth up to

- Rs 100, Re 1 will be charged per month

- Rs 101 to 500, Rs 2 will be charged per month

- Between Rs 501 to 1000 per month – Rs 5 will be charged per month.

- More than Rs 1001 per month – Rs 10 will be charged per month.

- Subscriber’s APY account will be deactivated after 12 months of non-payment

- Subscriber’s APY account will be frozen after 6 months on non-payment

- Subscriber’s APY account will be closed after 24 months of non-payment

Withdrawal Procedure from Atal Pension Yojana (APY)

There are three conditions for withdrawing money from the Atal Pension Yojana. The first condition is withdrawal after 60 years. In this case, subscribers will need to submit a request to the concerned bank for drawing the guaranteed minimum monthly pension or higher monthly pension.

The second condition is withdrawal before 60 years. In this case, a subscriber will be refunded the contributions made to the APY, along with the net actual interest earned on those contributions.

In the third condition, there could be two situations – if the beneficiary dies before the retirement age or after the retirement age. In the first case, if the beneficiary dies before the retirement age, then the spouse or nominee shall be entitled to continue with the scheme. On the other hand, if the beneficiary dies after the retirement age, the spouse or nominee will receive the pension.

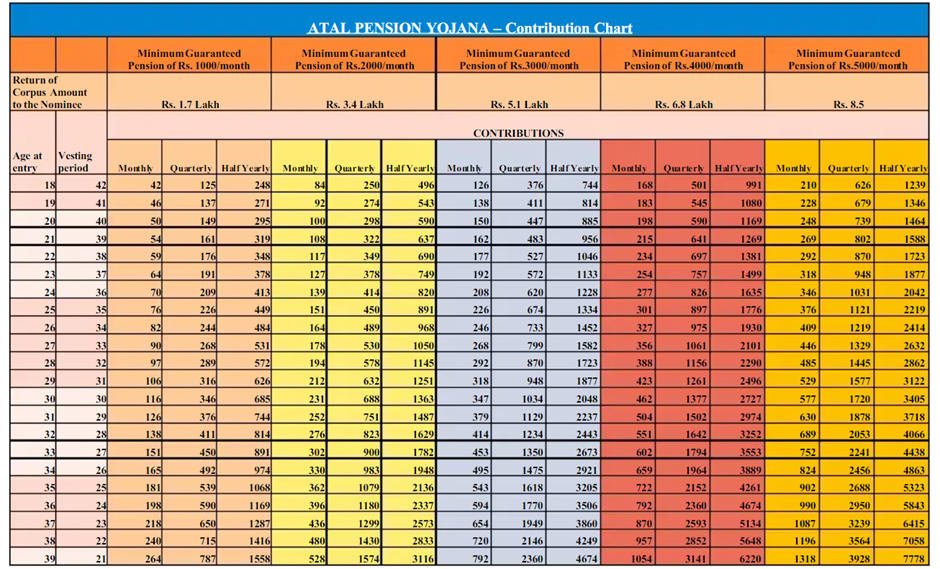

Atal Pension Yojana Contribution Chart

If you look at the chart, age and monthly, quarterly, and half yearly contributions are given. Age of entry is 18 years up to 39 years. It is clear from the chart that as age increases, the contribution amount increases.

Some Interesting Facts about the Atal Pension Yojana

Total enrolments under this scheme have been done by several financial institutions including:

- 70.44 percent by public-sector banks

- 19.80 percent by regional rural banks

- 6.18 percent by private sector banks

- 0.37 percent by payment banks

- 0.62 percent by small finance banks

- 2.39 percent by cooperative banks

APY is gaining huge popularity especially among women and youth. In the financial year 2024, 52% of all enrolments were women; and 70 percent of all subscribers since the inception of APY belong to the age group of 18 to 30 years. And, among all states of India, Uttar Pradesh has got the highest enrolments in the Atal Pension Yojana.

How to Apply for the Atal Pension Yojana?

If an individual wants to apply for the Atal Pension Yojana, they need to visit the bank branch where they have a savings account. They should fill out the APY registration form and provide a valid Aadhaar number and mobile number. It is important for the APY subscriber to maintain the required bank balance in the savings account for the transfer of the monthly instalment.

FAQs (Frequently Asked Questions)

Q. Is government co-contribution available for APY?

A. Government co-contribution was available for only 5 years i.e., from 2015-16 to 2019-2020.

Q. How much assured pension will be received under APY?

A. Guaranteed minimum pension of Rs 1000/2000/3000/4000/5000 per month will be given after reaching the age of 60 years depending on the contributions by the individuals.

Q. Whether Aadhaar number is compulsory for joining the Atal Pension Yojana?

A. It is mandatory for joining APY because this would be the primary KYC document for identification.

Q. Whether premature withdrawal of invested money is allowed?

A. Yes, it is allowed, however, the co-contribution amount from the government will not be refunded.

Q. How many APY account an individual can open?

A. One person can have only one APY account and it is unique.